By: IFG

March 21, 2012

Some say higher oil prices are essential to ending our addiction to fossil fuels.

While true in principle, the reality of recent rising costs to consumers has so far been the exact opposite, with political barriers bigger then ever. IFG research shows it can only get worse if current trends continue.

That’s because a major force driving gas prices upward is rampant speculation in unregulated oil derivatives. Charles and David Koch are dominant players who in turn plow their profits back in to preventing the phase out of fossil fuels having outspent Exxon and the American Petroleum Institute to kill climate legislation.

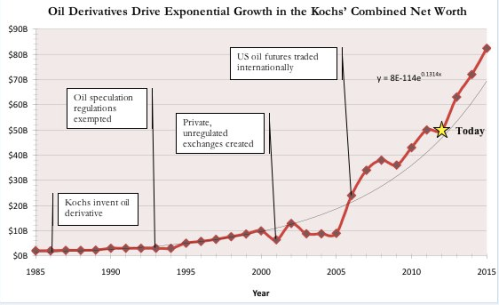

While the Koch’s family fortune has steadily expanded with the use of fossil fuels, not until recently did their net worth grow exponentially. That’s due in large part to their inventing oil derivatives, and then deregulating their trade on Wall Street, and the worldwide.

IFG charts (below) the Kochs’ combined net worth over the past 25 years. It shows how their wealth skyrocketed as speculation on oil markets went wild, with the Kochs making money even when the price of oil goes down.

- Koch wealth for the years 1989, 1995-2000, 2002, 2012-2015 are estimates.

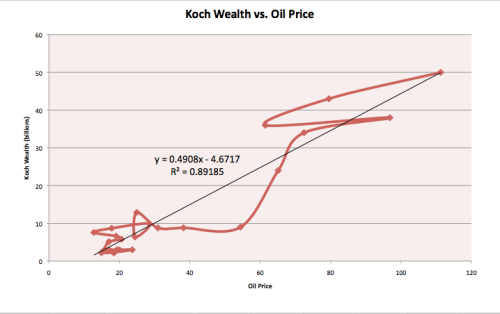

You can see that oil price and Koch wealth are very strongly correlated with a correlation coefficient of 0.94.

With no rules against insider trading, it’s no wonder that the guys who own so much oil infrastructure through which the commodity moves, and also invented the instrument by which traders gamble, can game the system to cash in on such a grand scale. The Kochs’ combined wealth now ranks them third richest in the world, according to Forbes.

Goldman Sachs recently reported that oil speculation imposes an extra cost of as much as $.56 per gallon of gasoline in the US, an incredible irony when one thinks that this money is then spent to stop the costs of climate change from being included in the price at the pump paid by consumers.

The true price of oil must ultimately reflect its full ecological and social costs, and achieving that requires reducing, if not removing, the role of money in politics. Climate campaigners are currently unable to do that alone, and therefore must work with other movements whose interests are also being bulldozed by these billionaire brothers.

The trajectory of their profits today implies that the undue influence of the Koch brothers is set to soar even higher. Assuming that koch wealth continues in its exponential path their combined wealth will be $82.4 billion in 2015. Their “shrink government” agenda—which comes amidst calls for massive market interventions to address today’s converging economic and ecological crises—is attacking the very right to clean air, the right to fair wages, and even the right to vote.

Unless key constituencies can come together to counter Koch cash, the implications for people and the planet could be devastating given the Kochs’ control over the current Congress has radically shifted US politics to the right and upcoming elections or ever more driven by cold hard cash. The Citizens United ruling has spun open the spigot so Koch cash can flow even more freely.

The premise of IFG’s Plutonomy Program is that globalization has, as predicted, upwardly redistributed wealth, where Ultra High Net Worth Individuals are increasingly enabled to exert their own political power and economic ideologies on democratic decision-making everywhere. Nowhere are the results more clearly expressed than in the rise of the Koch’s wealth and their increasing power over our lives.

Read More: How The Koch Are Fracking America, Charles And David Koch File Suit To Take Over The Cato Institute, Kochtopus Empire